Table of Content

Programs, rates, terms and conditions are subject to change without notice. You must live in a manufactured home purchased with an FHA loan. Please send your email request to which authorizes FHA.com to share your personal information with one mortgage lender licensed in your area to contact you.

This program lets buyers get a single loan with just one closing. Manufactured homes are built brand new with the cost to the consumer established prior to the home being built. Cost overruns and “change orders” common with newly constructed site-built properties are avoided.

News

Interest rates on FHA loans are negotiated between the borrower and the lender; mobile home loans through Title I come with fixed interest rates and typically last for 20 years. The borrower must plan to reside in the property as their primary residence. While modular homes are pre-fabricated like mobile homes, they are held to the same building codes that a traditional home must adhere to. This also leads to differences in the structure, such as the ability to include a second story in a modular home. From conventional loans to government-backed FHA, VA and USDA loans, learn about the different types of mortgage loans so you can choose the right one. If you have high credit scores or want to finance 100% of your purchase, consider the following manufactured home loan alternatives.

Shopping around for a lender is always a good idea, but in cases where lenders are scarce, it’s even more important. FHANewsblog.com is a digital resource that publishes timely news, information and advice concentrating on FHA, VA and USDA residential mortgage lending. We offer a full video library on the definitions of many basic mortgage terms. Our goal is to educate our readers as to the many ways they can achieve home ownership. Can I get a gift to help with my down payment and closing costs?

VA loan (government loan)

Also note that the FHA does not insure mortgages on manufactured homes built prior to June 15, 1976. Chattel loans and personal loans may have higher interest rates, but the shorter term means you could save money over the life of the loan when compared with traditional mortgages. We offer a complete range of conforming, non-conforming and government loan programs, as well as a variety of options to h... Search our wide selection of manufactured home lenders that can assist you with your manufactured home financing needs.

As a result, would-be homeowners simply don’t have as many financing options. Under the Title I program, FHA approved lenders make loans from their own funds to eligible borrowers to finance the purchase or refinance of a manufactured home and/or lot. FHA insures the lender against loss if the borrower defaults. Credit is granted based upon the applicant's credit history and ability to repay the loan in regular monthly installments. FHA home loan rules for manufactured housing don’t just list the credit score requirements and other financial qualifications needed to approve the loan.

Manufactured, Modular, and Mobile Home Lenders

Homebuyers with bumpy credit histories looking for lower-cost, easy-qualifying alternatives to site-built homes often choose FHA loans to buy mobile homes. An FHA manufactured home loan may provide a faster path to homeownership than other loan programs. FHA home loan rules for manufactured housing include age and foundation requirements as well as minimum sizes. If you aren’t sure how to proceed when trying to apply for a manufactured home loan, here are some common questions asked about these types of FHA mortgages. We do not offer or have any affiliation with loan modification, foreclosure prevention, payday loan, or short term loan services. Neither FHA.com nor its advertisers charge a fee or require anything other than a submission of qualifying information for comparison shopping ads.

Peace, harmony, healthy building materials, efficiency - at elk there is everything with comfort and a feel-good factor. Complete Guide to FHA LoansConsidering an FHA loan for your new home? Read about FHA loans and find out why they’re a popular option for first time homebuyers.

Single Family

Are you looking for a home loan you can use to buy manufactured housing? Buying a manufactured home with an FHA mortgage is definitely an option for those who qualify. But the home must meet minimum FHA requirements as well as state or local code. FHA loans are federally insured, meaning that lenders are protected if a borrower defaults on their mortgage. As a consequence, these lenders can offer more favorable terms, including lower interest rates, to borrowers who might not otherwise qualify for a home loan.

The loan type you select affects your monthly mortgage payment. Explore mortgage options to fit your purchasing scenario and save money. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments.

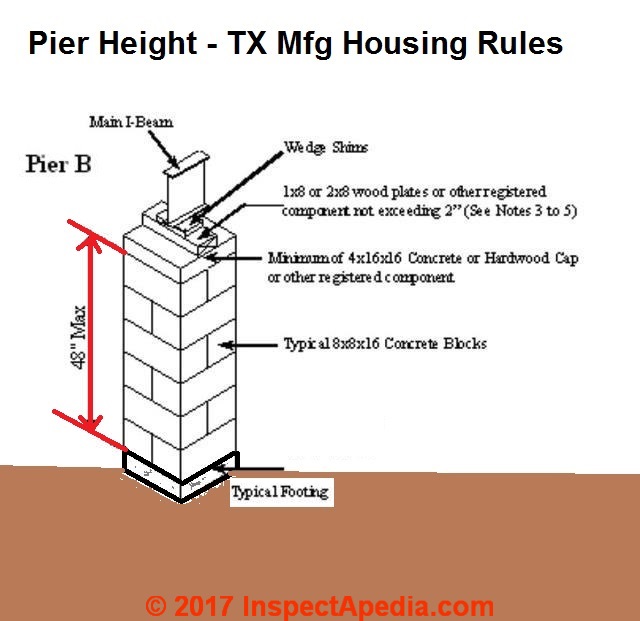

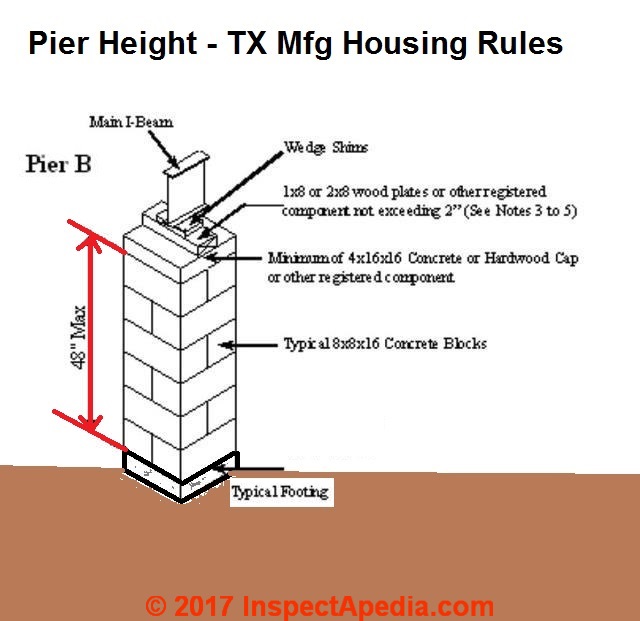

To be eligible for FHA mortgage insurance, the manufactured home must be built after June 15, 1976 and there must be a certification label to prove it. Manufactured home floor space can not be smaller than 400 square feet and must be classified as real estate. FHA mortgage loans are available for much more than just suburban homes or condominiums. FHA loans can also be used to purchasemanufactured homes and/or modular homes. Most manufactured homes will require a foundation inspection by a certified engineer before they are eligible for FHA financing. Keep in mind that these inspections can run upwards of $650, so be prepared for that extra cost if looking to finance a manufactured home with an FHA loan.

When you talk to lenders, ask about the loan officer’s experience working with FHA manufactured home loans. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . The proceeds of a Title I manufactured home loan may not be used to finance furniture (for example, beds, chairs, sofas, lamps, rugs, etc.).

FHA loan rules for manufactured homes include age and foundation requirements as well as minimum sizes. What type of credit score do I need to finance a mobile home? The minimum credit score requirement for mobile home financing depends on the lender and the type of loan you apply for. Senior investment advisor and credit consultant Bruce Mohr of Credit Sage says that financing referred to as a "chattel loan" can be a good option for manufactured housing. Certain farm equipment, as well as mobile homes, yachts, houseboats and aircraft, may be eligible for chattel mortgages, he says.

While certain amenities such as flooring or other options can be selected, you’re limited to the floor plans offered by the manufactured housing dealer. FHA loans for mobile homes offer the same benefits as for existing homes or newly constructed ones. That means a down payment as low as 3.5 percent of the sales price along with competitive interest rates. Mobile homes, also known as manufactured homes, represent more than one out of ten new homes built and provide an affordable alternative for home ownership.

The land lease typically needs to be at least three years or longer, renewable annually after the initial lease period ends and clearly state how much rent is paid for the land. The minimum down payment is 3.5%, and the purchase of the home and installation costs can be added to the loan amount. Have a suitable site on which to place the manufactured home. The home may be placed on a rental site in manufactured home park, provided the park and lease agreement meet FHA guidelines. The home may be situated on an individual homesite owned or leased by the borrower. Browse through our frequent homebuyer questions to learn the ins and outs of this government backed loan program.

No comments:

Post a Comment